Brand Finance Press Release – Top African Brands Lose US$5.5 Billion in Brand Value

Brand Finance Press Release – For immediate release

Top African Brands Lose US$5.5 Billion in Brand Value

- Total brand value of Africa’s top 150 most valuable brands drops 12% from US$45.5 billion in 2020 to US$40.0 billion in 2021

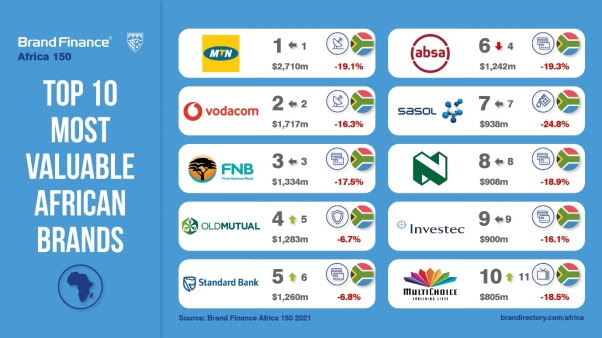

- MTN retains title of Africa’s most valuable brand, brand value US$2.7 billion

- South Africa dominates ranking with 81 brands featuring which account for 73% of total brand value. Nigeria, with 17 brands, and Morocco with 10, are next best represented nations in ranking

- Banking, telecoms, and insurance are continent’s most valuable sectors

- Capitec Bank overtakes Vodacom as Africa’s strongest brand, Brand Strength Index (BSI) score 89.2 out of 100

View the full Brand Finance Africa 150 2021 report here

Top African brands lose US$5.5 billion in brand value

The total value of Africa’s top 150 most valuable brands has declined by US$5.5 billion (12%) from US$45.5 billion in 2020 to US$40.0 billion in 2021, according to the latest Brand Finance Africa 150 2021 report.

The COVID-19 pandemic has played a key role in the downturn in the brand value of Africa’s top brands. Lockdown measures and travel bans were implemented throughout the year and across the continent, creating uncertainty and impacting brands’ ability to do business as usual.

Jeremy Sampson, Managing Director, Brand Finance Africa, commented:

“In a year that saw most African countries go into lockdown and significant unrest across the continent, a decline in total brand value for the top African brands is unsurprising. Following the pandemic, African brands will need to search for opportunities to make up lost ground. By embracing new technologies and collaboration, the continent can propel its recovery and bounce back from the extraordinary situation the world has found itself in.”

MTN peaks again

South Africa’s MTN has retained the title of Africa’s most valuable brand, despite recording a 19% drop in brand value to US$2.7 billion. The telecoms giant dominates on home soil too, this year holding onto its decade-long reign as South Africa’s most valuable brand, according to the Brand Finance South Africa 50 2021 report.

It has been a turbulent year for MTN, however, with the brand facing several scandals from its money mobile services been hacked in Uganda, to being accused of price discrimination practices alongside telecoms rival and second-ranked Vodacom (brand value down 16% to US$1.7 billion). MTN has also begun to scale down its operations, announcing its exit from the Middle East, in order to focus and build further across Africa.

Despite this, according to the Brand Finance Global Brand Equity Monitor, MTN is ranked 3rd among consumers for “Popularity with friends and family”, 4th for “Cool” and 4th for “Accessible anywhere and anytime”.

With the recent appointment of Ralph Mupita to the helm as CEO, as well as the successful launch of its 5G network across major South African cities, MTN will hope to use these developments as a springboard to capture some of its lost brand value moving forward.

South African brands dominate

South African brands dominate the Brand Finance Africa 150 2021 ranking once again, with the entire top ten hailing from the nation. In total, 81 South African brands feature with a cumulative brand value of US$29.0 billion, equating to 73% of the total brand value in the ranking – a 15% decrease from last year.

MTN and Vodacom lead the way, with First National Bank (brand value US$1.3 billion), Old Mutual (brand value US$1.3 billion) and Standard Bank (US$1.3 billion) completing the top five. In total, there are only 19 of the continent’s 54 countries with brand representation in the ranking.

Nigeria is South Africa’s closest competitor with 17 brands featuring, which account for 6% of the cumulative brand value in the ranking. 33 Export (down 8% to US$292 million) is Nigeria’s most valuable brand, sitting in 43rd in the overall ranking. This brand value decrease is in line with the trend seen for alcohol brands across the continent and the rest of the world with people going out and drinking less because of the pandemic.

Morocco is the third most represented nation in the ranking, with 10 brands featuring, which account for 6% of the total brand value. Claiming 13th spot is Maroc Telecom – the highest ranked brand from outside South Africa – jumping five spots following a modest 1% rise in brand value to US$761 million. The telecoms brand was able to capitalize on the increased reliability on its services over the previous year and a half, with both work and social lives forced to turn online, managing to increase its customer base, seeing an uptick of 10% in broadband users.

Banking, telecoms, and insurance are Africa’s most valuable sectors

Banking, telecoms, and insurance remain Africa’s most valuable sectors, but cumulative brand values across the sectors have taken a hit.

The continent’s most valuable sector, banking, has 36 brands featured in the ranking, accounting for 27% of the total brand value, but has dropped 12% year-on-year. The economic impacts of the COVID-19 pandemic are difficult to ignore, and this drop in brand value is in line with the negative trend seen across the rest of the world. There are a few outliers, however, Kenya Commercial Bank (up 12% to US$209 million), Morocco’s Bank of Africa (up 11% to US$221 million) and Nigeria’s Access Bank (up 8% to US$262 million) have all recorded solid brand value growth and are all their respective country’s fastest growing brands this year.

In second is the telecoms sector, with 26 brands featured and accounting for 21% of the total brand value in the ranking. Despite the sector boasting the number one and two ranked brands in the overall ranking, the industry still lost 13% of cumulative brand value year-on-year, down to US$8.5 billion. As with all big telcos globally, these brands are being squeezed from all sides as OTT messaging apps like WhatsApp are impacting voice and SMS revenue, and challenger brands offer comparable data services at below-market rates, leading to fierce price competition and decreasing margins.

The insurance sector fared slightly better than the other two, seeing only a 5% drop in total brand value to US$3.6 billion. Old Mutual retained its spot as the most valuable insurance brand in the ranking and moved up one spot to 4th, despite a 7% drop in brand value. However, the retail sector is rapidly catching up to insurance and held firm throughout the pandemic, only seeing a marginal drop in cumulative brand value, which now stands at US$3.4 billion. South Africa’s Shoprite saw a 1% drop in brand value to US$777 million but remains Africa’s most valuable retail brand, climbing five places to 11th.

Capitec Bank crowned Africa’s strongest brand

In addition to measuring brand value, Brand Finance also determines the relative strength of brands through a balanced scorecard of metrics evaluating marketing investment, stakeholder equity, and business performance. According to these criteria, Capitec Bank has overtaken Vodacom to be crowned Africa’s strongest brand, with a Brand Strength Index (BSI) score of 89.2 out of 100 and a corresponding AAA brand strength rating.

According to the Brand Finance Global Brand Equity Monitor, Capitec is one of the five most reputable banking brands in the world. Reputation (and the main drivers of reputation) is highly correlated with brand consideration. Banks that outperform in reputation – by excelling in meeting customer needs – also outperform in brand consideration. Capitec scores extremely highly for both.

Surpassing the 15 million client mark in December 2020, Capitec has more customers than any other South African bank, all of whom benefit from its excellent customer service and personalised banking experience. The pandemic increased the number of online shoppers to more than ever before – the banking brand responded by launching a virtual banking card, making online transactions easier and safer for its customers.

View the full Brand Finance Africa 150 2021 report here

ENDS

Note to Editors

The results of the Brand Finance Africa 150 2021 report will be presented at the IAA Africa Rising Leadership Conference being held on Tuesday 28th September at 10:45 BST. For more information or to register for the event please visit the Brand Finance events page here.

Every year, Brand Finance puts 5,000 of the biggest brands to the test, evaluating their strength and quantifying their value, and publishes nearly 100 reports, ranking brands across all sectors and countries. Africa’s 150 most valuable brands are included in the Brand Finance Africa 150 2021 report.

The full rankings, additional insights, charts, more information about the methodology, as well as definitions of key terms are to be found in the Brand Finance Africa 150 2021 report.

Brand value is understood as the net economic benefit that a brand owner would achieve by licensing the brand in the open market. Brand strength is the efficacy of a brand’s performance on intangible measures relative to its competitors. Please see below for a full explanation of our methodology.

Media Contacts

Jeremy Sampson

Managing Director, Brand Finance Africa

M: +27 82 8857300

j.sampson@brandfinance.com

Konrad Jagodzinski

Communications Director

T: +44 (0)207 389 9405

k.jagodzinski@brandfinance.com

Florina Cormack-Loyd

Associate Communications Director

T: +44 (0)207 389 9444

f.cormackloyd@brandfinance.com

James Haggis

Communications Executive

T: +44 (0)20 7389 9418

j.haggis@brand-dialogue.com

Follow Brand Finance on LinkedIn, Twitter, Facebook, Instagram, and YouTube.

About Brand Finance

Brand Finance is the world’s leading brand valuation consultancy. Bridging the gap between marketing and finance, Brand Finance evaluates the strength of brands and quantifies their financial value to help organisations of all kinds make strategic decisions.

Headquartered in London, Brand Finance has offices in over 20 countries, offering services on all continents. Every year, Brand Finance conducts more than 5,000 brand valuations, supported by original market research, and publishes nearly 100 reports which rank brands across all sectors and countries.

Brand Finance is a regulated accountancy firm, leading the standardisation of the brand valuation industry. Brand Finance was the first to be certified by independent auditors as compliant with both ISO 10668 and ISO 20671, and has received the official endorsement of the Marketing Accountability Standards Board (MASB) in the United States.

Methodology

Definition of Brand

Brand is defined as a marketing-related intangible asset including, but not limited to, names, terms, signs, symbols, logos, and designs, intended to identify goods, services, or entities, creating distinctive images and associations in the minds of stakeholders, thereby generating economic benefits.

Brand Value

Brand value refers to the present value of earnings specifically related to brand reputation. Organisations own and control these earnings by owning trademark rights.

All brand valuation methodologies are essentially trying to identify this, although the approach and assumptions differ. As a result, published brand values can be different.

These differences are similar to the way equity analysts provide business valuations that are different to one another. The only way you find out the “real” value is by looking at what people really pay.

As a result, Brand Finance always incorporates a review of what users of brands actually pay for the use of brands in the form of brand royalty agreements, which are found in more or less every sector in the world.

This is known as the “Royalty Relief” methodology and is by far the most widely used approach for brand valuations since it is grounded in reality.

It is the basis for our public rankings but we always augment it with a real understanding of people’s perceptions and their effects on demand – from our database of market research on over 3000 brands in over 30 markets.

Brand Valuation Methodology

For our rankings, Brand Finance uses the simplest method possible to help readers understand, gain trust in, and actively use brand valuations.

Brand Finance calculates the values of brands in its rankings using the Royalty Relief approach – a brand valuation method compliant with the industry standards set in ISO 10668.

Our Brand Strength Index assessment, a balanced scorecard of brand-related measures, is also compliant with international standards (ISO 20671) and operates as a predictive tool of future brand value changes and a control panel to help business improving marketing.

We do this in the following four steps:

1. Brand Impact

We review what brands already pay in royalty agreements. This is augmented by an analysis of how brands impact profitability in the sector versus generic brands.

This results in a range of possible royalties that could be charged in the sector for brands (for example a range of 0% to 2% of revenue).

2. Brand Strength

We adjust the rate higher or lower for brands by analysing Brand Strength. We analyse brand strength by looking at three core pillars: “Investment” which are activities supporting the future strength of the brand; “Equity” which are real perceptions sourced from our original market research and other data partners; “Performance” which are brand-related measures of business results, such as market share.

Each brand is assigned a Brand Strength Index (BSI) score out of 100, which feeds into the brand value calculation. Based on the score, each brand is assigned a corresponding Brand Rating up to AAA+, in a format similar to a credit rating.

3. Brand Impact x Brand Strength

The BSI score is applied to the royalty range to arrive at a royalty rate. For example, if the royalty range in a sector is 0-5% and a brand has a BSI score of 80 out of 100, then an appropriate royalty rate for the use of this brand in the given sector will be 4%.

4. Brand Value Calculation

We determine brand-specific revenues as a proportion of parent company revenues attributable to the brand in question and forecast those revenues by analysing historic revenues, equity analyst forecasts, and economic growth rates.

We then apply the royalty rate to the forecast revenues to derive brand revenues and apply the relevant valuation assumptions to arrive at a discounted, post-tax present value which equals the brand value.

Disclaimer

Brand Finance has produced this study with an independent and unbiased analysis. The values derived and opinions presented in this study are based on publicly available information and certain assumptions that Brand Finance used where such data was deficient or unclear. Brand Finance accepts no responsibility and will not be liable in the event that the publicly available information relied upon is subsequently found to be inaccurate. The opinions and financial analysis expressed in the study are not to be construed as providing investment or business advice. Brand Finance does not intend the study to be relied upon for any reason and excludes all liability to any body, government, or organisation.

The data presented in this study form part of Brand Finance’s proprietary database, are provided for the benefit of the media, and are not to be used in part or in full for any commercial or technical purpose without written permission from Brand Finance.

Crave multi-disciplinary obscene videos that AREN’t terrible?

Then you’ve come to the absolutely right place!

We give you unlimited access to all premium dirty videos in high resolution.

Anal, youth, hardcore… we have it all!

Watch the videos available for each device of your choice, whether it’s a mobile phone, desktop computer or tablet computer.

Don’t forget to check out the other erotic niches featured on this site — you’ll love this experience!

http://expertthinking.co/__media__/js/netsoltrademark.php?d=https://3megaxxx.com

http://nevadaslist.com/__media__/js/netsoltrademark.php?d=https://3megaxxx.com

http://fjv.digitalstorage.net/__media__/js/netsoltrademark.php?d=https://3megaxxx.com

http://willhaydengreen.com/__media__/js/netsoltrademark.php?d=https://3megaxxx.com

http://sfrcoin.com/__media__/js/netsoltrademark.php?d=https://3megaxxx.com